Ce document est en Français.

With our Annual Budget Planner, you can:

- Set Clear Financial Goals: Define your short-term and long-term financial objectives, whether it’s saving for a dream vacation, purchasing a home, or building an emergency fund.

- Track Income and Expenses: Monitor your monthly income streams and categorize expenses to identify spending patterns, pinpoint areas for improvement, and optimize your budget.

- Plan for Savings: Allocate funds for savings accounts, ensuring that you stay on track to meet your financial milestones.

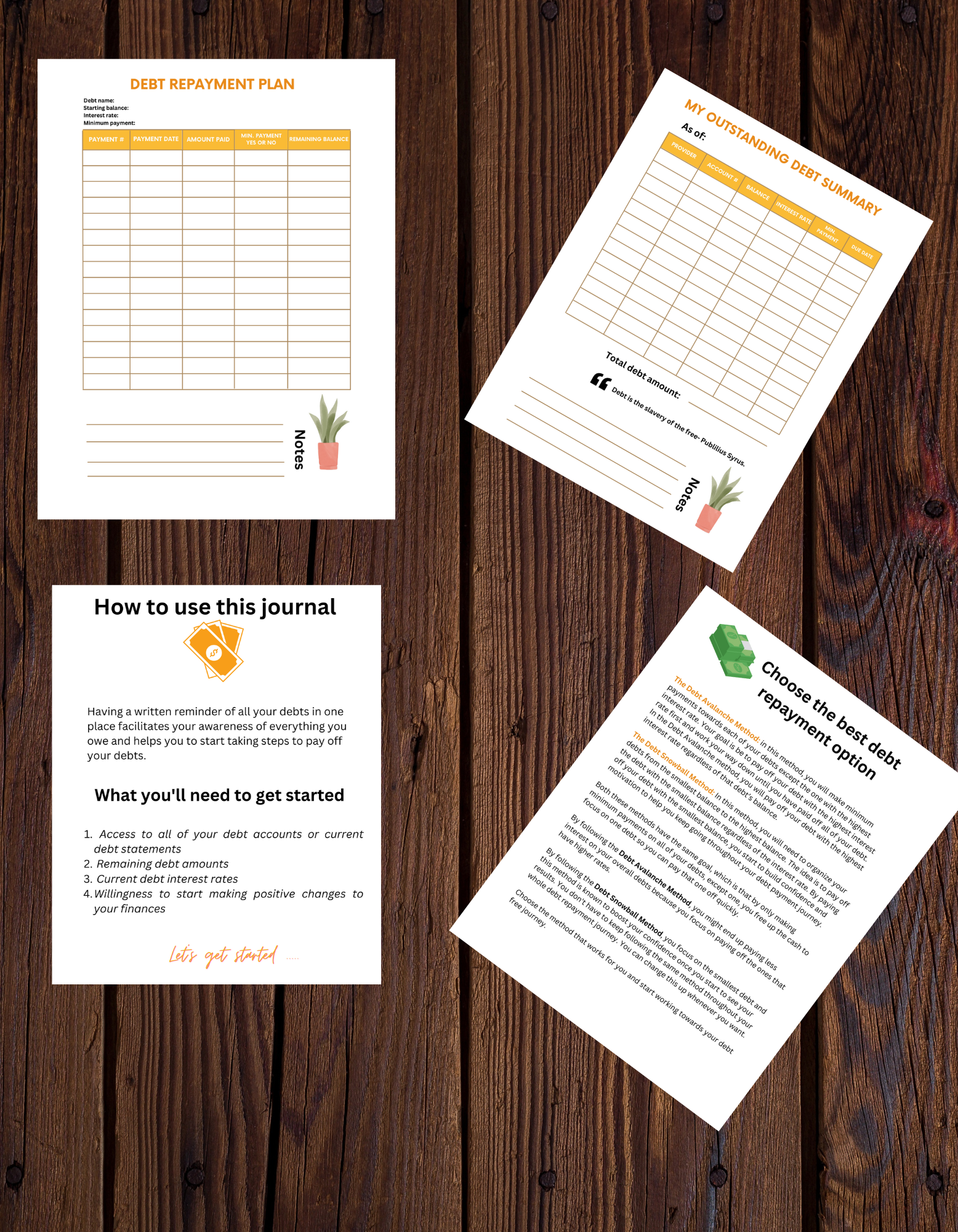

- Manage Debt: Keep tabs on outstanding loans, credit card balances, and repayment schedules to effectively manage debt and work towards becoming debt-free.

- Visualize Financial Progress: Utilize visual aids to visualize your financial progress over time, empowering you to stay motivated and stay on course towards financial success.

- Stay Organized: Enjoy the convenience of a structured layout with dedicated sections for each aspect of your finances, making it easy to stay organized and maintain financial discipline.

- Adapt and Adjust: Flexibility is key! Our planner allows you to adapt and adjust your budget as circumstances change, ensuring that your financial plan remains relevant and effective throughout the year.

Don’t let financial uncertainty hold you back. Take charge of your financial future today with our Annual Budget Planner and embark on a journey towards financial freedom and prosperity.

What this planner includes:

– Debt tracker

– Savings tracker

-Debt payoff tracker

– Annual Savings goals

– Daily expense tracker

– Monthly expense tracker

– Monthly budget tracker